The Transformative Executive is a ‘Maverick’

The transformative executive is a ‘maverick’. Not in the sense of the Tom Cruise character in Top Gun. Rather, the maverick is a groundbreaker. A maverick is a transformational executive who creates a high customer satisfaction, high profit, low cost, high employee retention business model for mortgage lending.

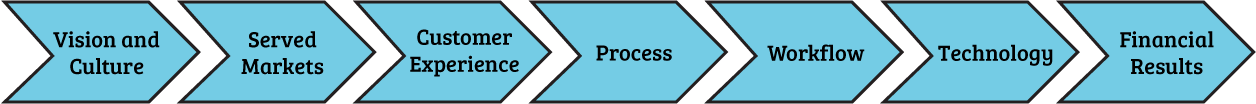

How does a transformational executive create a high customer satisfaction, high profit, low cost, high employee retention business model? From speaking with 25 or so maverick CEOs, it starts with a vision which shapes a culture that shapes the desired customer experience, which shapes process and workflow, which shapes technology choices, which then delivers profitable financial results.

Vision

The vision should communicate what your customer can expect.

Served Markets

The vision should communicate what your customer can expect.

Customer Experience

Customer experience is how a lender builds the confidence and trust of the borrower.

Process

The mortgage banking process is very complicated and highly regulated. The process used by a lender describes what has to be accomplished to move from the very beginning of the customer’s interest in your company, all the way through taking the application, closing the loan, establishing the loan servicing experience, and serving that customer’s financing needs for life, all in a manner that meets the customer’s expectation for their experience.

Workflow

Workflow is how the lender’s process is translated into the individual tasks necessary to complete the loan.

Technology

So, when asking lender CEOs how satisfied they are with their technology (CRM and lead management, loan origination system, pricing engine, secondary marketing systems, servicing system, among others), the answers ran from pretty satisfied to not satisfied at all.

Lenders with well-defined vision, culture and desired customer experience, process and workflow are generally much happier with their technology systems than those lenders that have not linked each of these elements of the value chain. Technology providers confide that the better defined and documented the elements discussed above are, the better able the lender is to obtain results from the technology.

Defining the back-end or destination helps shape the process moving forward to the beginning of the process as a conscious choice, not as something that is left to circumstances. Customer satisfaction, service level timeframes, defect free loan file. No rework or investor stipulations prior to secondary market sale and superior profitability are all influenced by the process. It’s much more difficult to correct an error or exception downstream as opposed to correcting it early in the process. If one designs from the backend forward, it forces each process and workflow to be standardized and optimized to deliver the desired result.

Financial Results

The measurable results of a well-defined process, workflow and technology plan are customer satisfaction, profitability, cost, loan defects and employee retention.